If you’ve been in sales or marketing for any length of time, you’ve heard it:

“Those leads are dead. Just get me new ones.”

But the data tells a very different story. Studies show that 96–97% of website visitors aren’t ready to buy on their first visit, which is why so many teams lean on follow-ups, retargeting, and nurture to convert interest over time. And in sales, only about 2% of deals close on the first contact, while the majority require multiple follow-ups.

In other words: “cold” usually means “we stopped showing up,” not “they’ll never buy.”

This article is a playbook for how to re-engage cold leads in a way that’s respectful, data-aware, and revenue-focused—using behavioral signals plus dual-channel email and direct mail. MailX2-style visitor identification and multi-channel execution make this easier, but the framework works even if you’re starting from a simple CRM and ESP.

The Myth of the “Dead” Lead

Why time since last touch is a terrible proxy for intent

Most CRMs call a lead “cold” after some arbitrary number of days without opens, clicks, or calls. That’s convenient for reporting—but it’s a bad proxy for actual buying intent.

Real buyers:

- Get busy

- Change jobs

- Wait for budget cycles

- Revisit vendors after internal priorities shift

Sales stats show that 80% of sales need 5–12 touches, yet almost half of salespeople give up after a single follow-up. “Cold” often just means “we stopped following up long before the buyer’s situation stabilized.”

Evidence that most visitors aren’t ready to buy on first contact

Lead-gen benchmarks estimate that around 96% of website visitors are not ready to buy on the first visit. Smart teams respond with:

- Email follow-ups

- Retargeting

- Educational content and win-back campaigns

Not with:

- Letting interested visitors slip away forever

- Buying more and more top-of-funnel leads to replace them

How pipeline labeling habits cause silent lost revenue

The way you label leads matters. When “MQL,” “SQL,” “stale,” and “dead” are driven by internal convenience rather than buyer behavior, you create structural blind spots:

- Old opportunities never revisited after timing changes

- Leads with real engagement buried under “cold” tags

- Whole campaigns never tested on your most familiar, lowest-CAC audience

When you reframe “dead leads” as dormant assets, you unlock a new lever: reactivation revenue.

Understanding the Psychology of “Not Now” Buyers

Timing, budget cycles, and internal politics in B2B

In B2B, “not now” can mean:

- Budget opens in Q3, not Q1

- A champion leaves, then a new one arrives

- Legal or procurement slows everything down

Those forces have nothing to do with the value of your solution. They’re about internal timing. If you disappear when the first champion goes quiet, you’re not there when the second champion starts searching again.

Life events, seasonality, and competing priorities in B2C

In B2C, similar patterns show up as:

- Seasonal buying (tax season, holidays, back-to-school)

- Life events (moving, new job, new baby)

- Short-term financial stress

Customer retention research shows that win-back campaigns can be highly cost-effective because these people already know your brand and have shorter paths to purchase than net-new leads.

What signals distinguish “never” from “not yet”

Instead of guessing, build a simple signal model:

“Not yet” indicators

- Multiple site visits or product page views

- Past purchases or strong browsing behavior

- Opened or clicked some emails, even if sporadically

“Probably never” indicators

- Repeated hard bounces, spam complaints, or unsubscribes

- Clear negative feedback (“not a fit,” “wrong market”)

- Contacts added through purchased or non-consent-based lists

Your reactivation strategy should focus on the “not yet” group, while rigorously excluding the “probably never” group to protect your brand and deliverability.

POV – Why Buying New Leads While Ignoring Old Ones Is a Red Flag

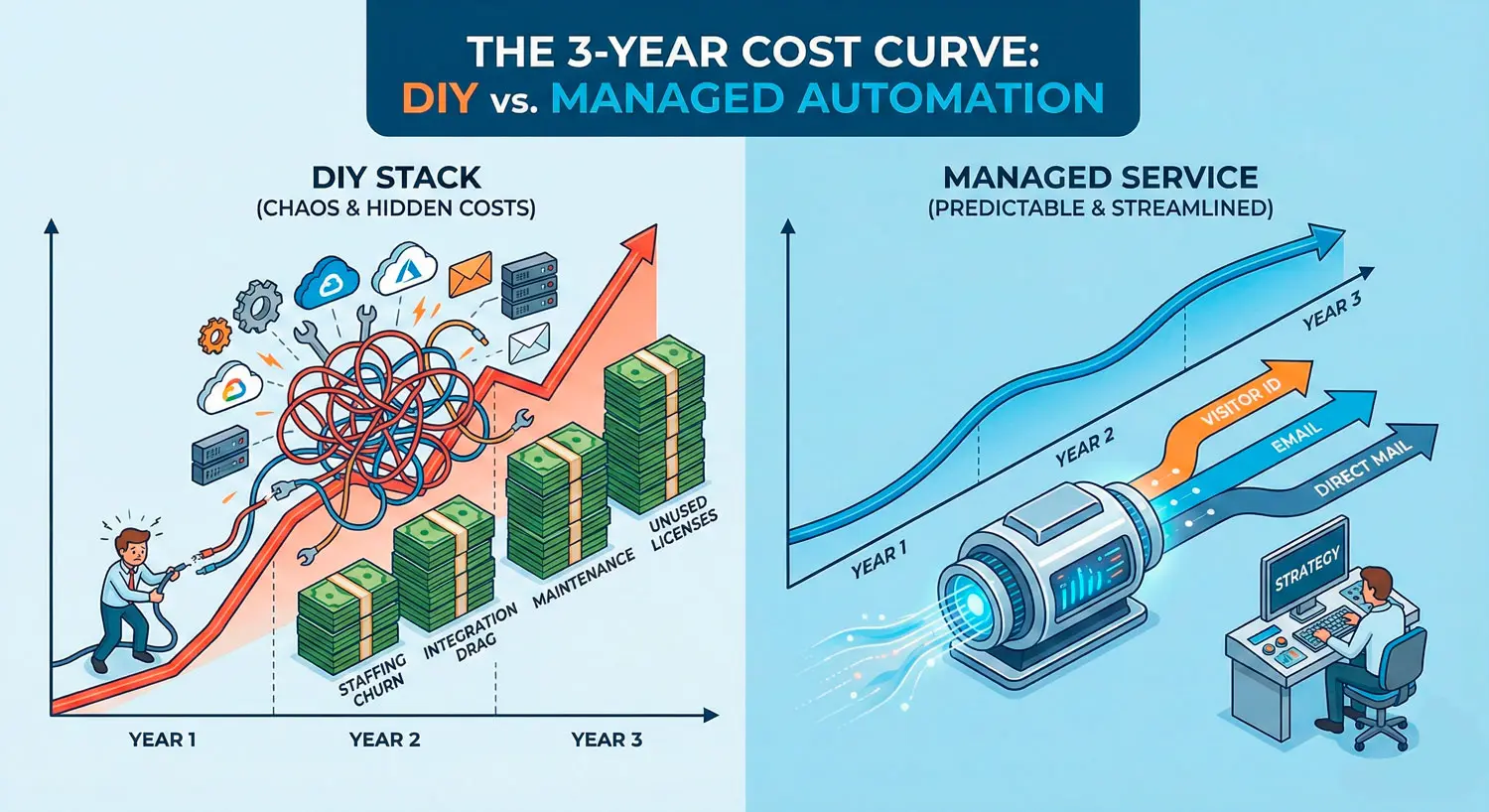

CAC inflation vs the near-zero cost of reactivation

Acquiring net-new leads is expensive:

- Paid search and social keep getting pricier

- Organic visibility takes time and resources

- List buys (which you should avoid) also harm deliverability and reputation

By contrast, re-engaging cold leads leverages:

- People who already know your brand

- Contacts you’ve already paid to acquire

- Existing behavioral and profile data

Win-back research notes that retaining or reactivating customers can be five to seven times more cost-effective than acquiring new ones, and that recipients of win-back emails are significantly more likely to engage with subsequent messages.

When lead-gen addiction masks nurture dysfunction

If you’re constantly asking for more leads while:

- Letting existing leads age out after a single sequence

- Never revisiting older segments with new offers or content

- Having limited visibility into reactivation performance

you’re probably dealing with a nurture problem, not a top-of-funnel problem.

Simple math: small reactivation gains vs large new-lead costs

Consider:

- A list of 20,000 “cold” contacts

- A reactivation program that persuades just 3–5% to meaningfully re-engage (click, reply, visit high-intent pages)

- A portion of those re-engaged leads convert to opportunities

Even modest wins can look like:

- Hundreds of leads revived

- Dozens of new opportunities

- A pipeline contribution rivaling a fresh lead-gen campaign

All without buying a single net-new lead.

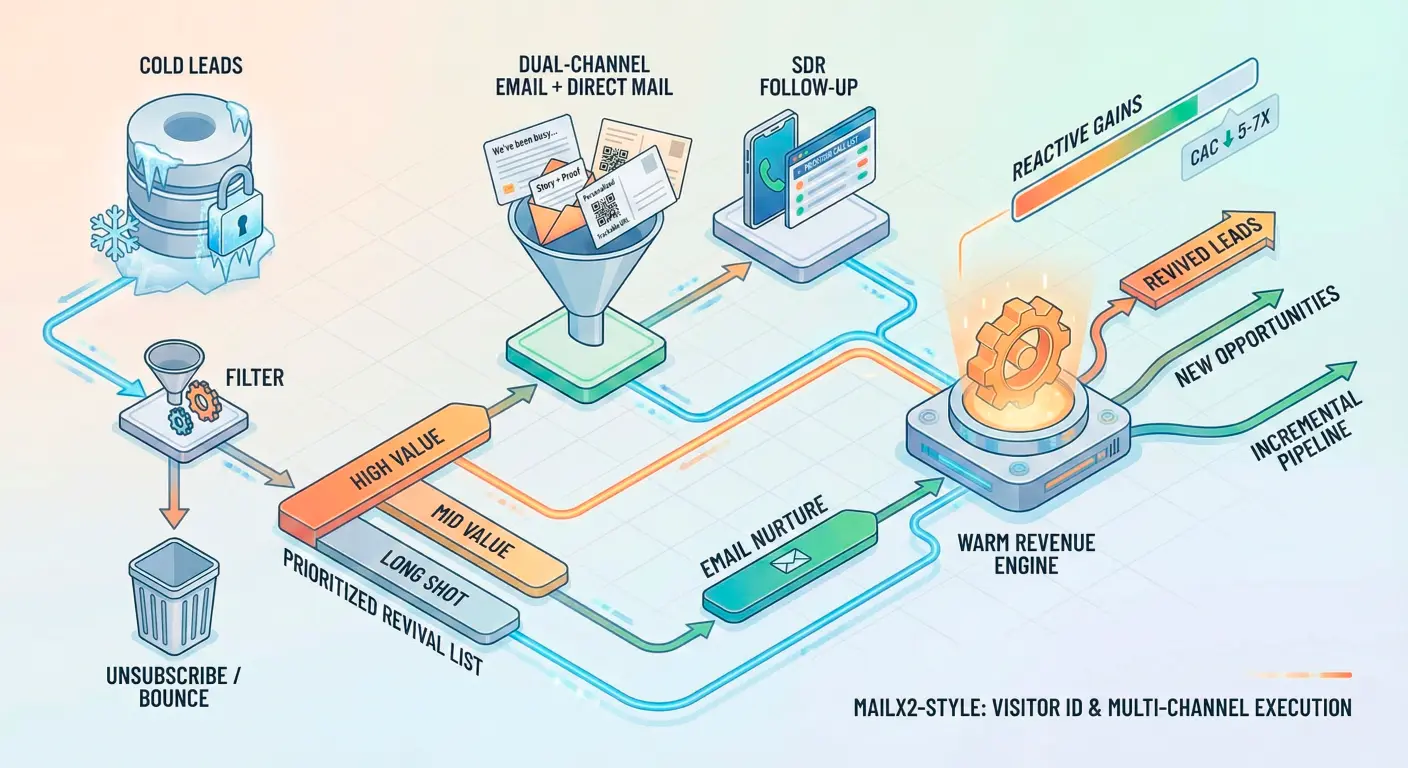

Decision Point – Which “Cold” Leads Are Worth Waking Up?

Before you design campaigns, you need a prioritized revival list, not a one-size-fits-all blast.

Behavioral and firmographic filters

Start by prioritizing leads who show any of the following:

- High-value behaviors (pricing page, product tours, long dwell times)

- Multiple interactions across channels (web, email, events)

- Fit with your ideal customer profile (company size, industry, role, LTV)

Lead-gen reports emphasize that combining behavioral data with profile data yields better prioritization and ROI.

If you’re using visitor identification (MailX2-style), you can also surface:

- Anonymous or “unknown” visitors who match existing CRM records

- Returning “cold” leads who are quietly visiting again

These become prime candidates for high-value reactivation.

Negative filters: who should not be included

To protect your sender reputation and respect consent, exclude:

- Hard bounces and repeatedly undeliverable addresses

- Spam traps and suspicious addresses

- Contacts who explicitly unsubscribed or opted out

- People whose data you can’t lawfully process anymore (privacy requests)

Modern deliverability guides emphasize that regularly removing inactive and risky contacts is critical to maintaining inbox placement.

Building a prioritized “revival list”

Segment your “revival list” roughly into:

- High-value revivals

- High ACV / VIP customers

- Target accounts

- Warm behaviors (recent visits, content downloads)

- Mid-value revivals

- Solid fit, moderate engagement

- Might respond well to education and “what’s new” content

- Long-shot revivals

- Older, low-engagement records that still look valid

- Only worth touching lightly and rarely

This lets you tailor your re-engage cold leads playbook by value and risk.

Designing a Dual-Channel Cold Lead Revival Journey

Email alone can work, but adding direct mail for top segments changes the economics. Research suggests typical email response rates hover around 1% or less, while direct mail often delivers 2.7–5%+ response rates, sometimes higher in house lists.

Email touches: story-led, value-first, segmented by dormancy reason

For each segment, design a short sequence (3–5 emails over a few weeks):

- Email 1 – “We’ve been busy (and so have you)”

- Acknowledge the gap

- Share what’s changed: new features, case studies, pricing, or positioning

- Offer a simple “still relevant?” click

- Email 2 – “Story + proof”

- Tell a short story about a customer who went quiet, then got results after engaging again

- Include clear social proof and a low-friction CTA (resource, webinar, or diagnostic)

- Email 3 – “Choose your path”

- Let them choose preferences: learn more, talk to sales, or reduce frequency

- Make unsubscribe easy and respectful to protect deliverability

Tie messaging to why they went cold:

- Price sensitive? Lead with ROI stories.

- Confused about fit? Lead with use cases and clarifying content.

- Timing issues? Lead with “what’s changed since we last spoke.”

When to add direct mail for higher-value segments

For top-tier segments (key accounts, high ACV, strategic customers), layer in direct mail:

- A concise, high-quality postcard or letter referencing the same narrative as your email series

- A clear, trackable CTA (personalized URL, QR code, or booking link)

Direct mail benchmarks show average response rates in the 3–5%+ range, significantly higher than typical email campaigns, particularly on house lists. When combined with behavior-aware email, that’s often enough to materially lift reactivation.

With a MailX2-style platform, your visitor identification and profiles can drive which leads receive mail and when, rather than blasting entire lists.

Aligning SDR follow-up with the warmest responses

Finally, ensure sales or SDR teams are plugged into the signals:

- Opens and clicks on revival emails

- Direct mail responses

- Return visits to pricing or product pages

Give SDRs:

- A prioritized call list each week

- Context on which narrative the lead saw

- Clear guidance on tone (“we’re checking in because you raised your hand again,” not “we saw you click a link”).

Common Mistakes That Make Cold Leads Colder

Mistake 1: Leading with discounts instead of relevance

Jumping straight to “Here’s 20% off” can:

- Devalue your proposition

- Attract price-only buyers

- Feel desperate or off-brand

Instead, lead with context and relevance: what’s new, why now, and what problem you can now solve better.

Mistake 2: Repeating the exact same offer that failed last time

If it didn’t work the first time, repetition without change isn’t persistence; it’s noise.

Change one or more of:

- The problem you highlight

- The social proof you use

- The offer format (training, audit, roadmap, trial)

Win-back best practices emphasize testing different timing, offers, and creative until you find what resonates, not just resending the same email.

Mistake 3: Sending low-value content “just to touch base”

Low-effort “touching base” emails train people to ignore you.

Every touch in your reactivation strategy should:

- Deliver a clear insight, resource, or decision shortcut

- Respect their time and inbox

- Make the next step obvious

Transformation – From Cold Database to Warm Revenue Engine

Before/after: win-back revenue and revived opportunities

Imagine a “before” state:

- 50,000 “cold” contacts in your CRM

- No structured reactivation

- Sales constantly asking for new leads

Then an “after” state:

- Clear revival segments based on fit and behavior

- A running dual-channel program (email + selective direct mail)

- A steady trickle of revived leads and opportunities each month

Studies on win-back campaigns show that re-engaged subscribers often remain more engaged over time, with many reading subsequent messages and shortening sales cycles because they already know the brand.

How reactivation builds a stronger “known audience”

Every cold lead you revive:

- Increases your first-party audience

- Provides richer behavioral data for future campaigns

- Lowers your effective CAC over time

This becomes even more important in a world where third-party cookies are fading and first-party relationships drive targeting and measurement.

Cultural shift: treating leads as long-term relationships

The most important transformation is cultural:

- Sales stops declaring leads “dead” after a few touches

- Marketing designs for longer buying journeys

- Leadership evaluates acquisition and reactivation as twin growth levers

MailX2-style visitor identification and dual-channel execution are the infrastructure for that mindset: they keep dormant relationships findable, contactable, and measurable—so your team can stay present when “not now” quietly turns into “now.”

30-Day Plan to Launch Your First Cold Lead Revival Program

You don’t need a massive overhaul to start. Here’s a 30-day, realistic plan.

Week 1: Data hygiene and segmentation

- Pull all “cold” leads based on your current definitions (e.g., no activity for 6–12 months).

- Apply negative filters: remove bounces, spam traps, unsubscribes, and non-consent contacts.

- Segment by value and behavior: high-value, mid-value, long-shot.

- If you use visitor ID, cross-reference web activity to identify returning “cold” leads.

Week 2: Copy, creative, and offer design for email + mail

- Draft a 3–4 email sequence for each key segment: story-led, value-first, with a clear way to say “yes,” “not now,” or “no thanks.”

- Design one or two direct mail pieces for top segments that echo the same narrative and CTA.

- Align SDR and sales scripts to the campaign story so follow-up feels continuous, not random.

Week 3–4: Launch, monitor, and tune based on early signals

- Launch the program to a limited slice first (e.g., 5–10% of your cold list) to validate deliverability and engagement.

- Monitor:

- Delivery, bounce, and spam complaint rates

- Opens, clicks, site visits

- Direct mail response and booked conversations

- Adjust subject lines, offers, and cadence based on early data.

Then expand to the rest of your prioritized segments, and make reactivation a standing lifecycle program, not a one-off stunt.

When you’re ready for help, a managed platform like MailX2 can:

- Identify which “cold” leads are actually active again on your site

- Orchestrate coordinated email + direct mail revival journeys

- Report on incremental pipeline from reactivation, not just opens

And importantly, they can do it without your team having to build every workflow by hand.