Peak season ends and it feels like you should finally breathe. But instead, you’re stuck in a messy middle: fulfillment catch-up, customer emails, returns, inventory, and planning the next push—while your marketing quietly goes dark.

That’s when the post-peak slump shows up. Traffic cools. Orders normalize. And the momentum you fought for during peak season fades faster than it should—not because customers suddenly stopped caring, but because follow-up and re-engagement fall apart.

Is it normal that SMBs struggle with follow-up?

This isn’t about working harder. It’s about understanding where customers drop off right after peak, then putting a light, repeatable calendar in place so you keep showing up while ops takes over. The goal is simple: restart customer engagement without adding more work.

The post-peak slump isn’t a demand problem—it’s a follow-up gap

When peak season ends, it’s easy to assume demand “disappeared.” But many small businesses don’t actually lose interest all at once. They lose continuity.

During peak, people are browsing constantly, buying gifts, comparing options, and coming back to your site multiple times. You’ve got attention. You’ve got intent. You’ve got a lot of “almost” moments.

After peak, those customers don’t vanish—they just move on to the next thing. And warm intent decays when nothing happens next.

A few common ways this shows up:

- First-time buyers never hear from you again. They were happy, then they forget you exist.

- Gift-related customers fall through the cracks. The buyer is different from the recipient, and you don’t know who to nurture.

- Browsers and cart abandoners cool off. They were close, then they stop seeing you.

- Returns/support customers only remember the problem. They associate your brand with friction, not value.

The hidden cost isn’t just a slower week. It’s the loss of a bridge between peak-season demand and the rest of the year.

Where momentum leaks: the 5-step follow-up funnel most SMBs don’t systemize

Most SMB follow-up struggles come from the same issue: there’s no system for what happens after peak. Customers are in different states, but they’re treated as one group—if they’re followed up with at all.

Here’s a practical five-step funnel to map your leaks.

Step 1: Peak buyers (first purchase)

Peak season brings in a wave of first-time buyers. Some are thrilled. Some are uncertain. Many are still forming an impression of your brand.

If you don’t guide them after the purchase, the relationship ends at “transaction completed.” That’s a leak.

What they often need right after peak:

- reassurance (you made a good choice)

- clarity (how to use/care/choose next)

- a reason to return (not necessarily a discount)

Step 2: Gift recipients / “not the buyer” audience

Peak season creates a weird customer category: the person using the product may not be the person who paid for it.

If you only follow up with the purchaser, you miss the person who could become a real repeat customer later. If you only follow up with the recipient (if you can), you may lack context.

This is a leak because gift season creates interest that doesn’t fit your normal buyer journey.

Step 3: Browsers + cart abandoners who were close

Peak browsing behavior is high-intent, even if it doesn’t convert. People compare. They price-check. They get distracted. They mean to come back.

If follow-up goes quiet after peak, those near-misses never get a second chance. That’s a leak.

Step 4: Customers with a support/returns experience

After peak, returns and support volume spike for many SMBs. That’s normal. What isn’t automatic is rebuilding trust after a friction moment.

If the only follow-up they receive is transactional (refund processed, ticket closed), you leave the relationship in a “problem” frame.

This is a leak because these customers often need reassurance and clarity more than anyone else.

Step 5: Past customers who need a reason to come back

You likely have customers who bought before peak, during peak, or long before. After peak, they need a reason to re-engage that feels relevant to their life—not just “we’re still here.”

If your only post-peak message is a generic promo blast, you’re trying to solve a relationship problem with a coupon. Sometimes that works, but it rarely builds a stable baseline.

A quick diagnosis: which leak matches your situation right now?

If you’re in the post-peak slump, you don’t need to fix everything at once. You need to identify your biggest leak and patch it first.

Here are four patterns that show up most often.

“We’re swamped with ops” leak

If your days are dominated by fulfillment, support, and inventory, follow-up becomes “later.” Later turns into never.

Signs:

- You have good intentions but no consistent sending rhythm.

- You’re operating entirely from your inbox and to-do list.

- You remember follow-up only when things slow down (which they don’t).

What this really means: you need a calendar that runs even when you’re busy.

“We don’t know who to follow up with” leak

Peak season creates a blur of customers and behavior. Without basic grouping, it’s hard to choose who gets what.

Signs:

- Everyone is treated the same in email (if you email at all).

- You don’t have a clear list of “warm” audiences post-peak.

- You avoid follow-up because it feels messy and uncertain.

What this really means: you need simple segments, not perfect ones.

“We only follow up with discounts” leak

If your only follow-up lever is a discount, you’ll hesitate to follow up at all—because discounts have real costs.

Signs:

- You blast a coupon to wake the list, then go silent.

- You feel like any email without a deal won’t work.

- Customers seem conditioned to wait for promos.

What this really means: you need follow-up messages that deliver value, not just offers.

“We followed up once, then stopped” leak

You sent a post-peak email. It did okay. Then the next week got busy and the rhythm died.

Signs:

- Your follow-up is a single email, not a sequence.

- You don’t have a repeatable schedule.

- You’re relying on motivation instead of structure.

What this really means: you need a minimum viable rhythm you can sustain.

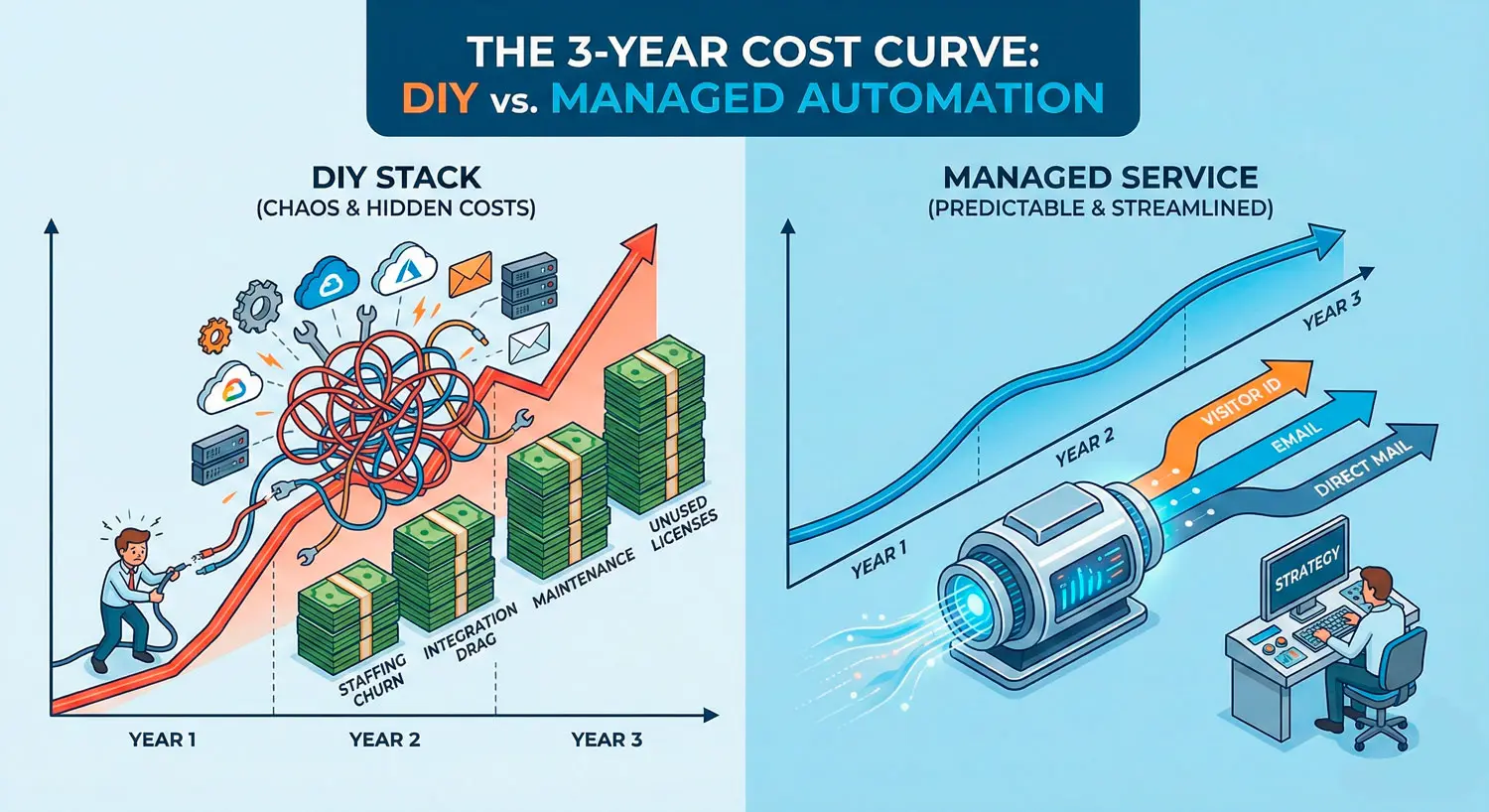

The contrarian fix: follow-up isn’t a campaign—it’s a calendar

A lot of SMBs tell themselves, “We’ll do a re-engagement campaign.” It sounds clean. It sounds like a project you can complete.

But follow-up fails after peak season because it’s rarely a one-time problem. It’s a consistency problem.

Campaign thinking leads to:

- overbuilding a big sequence you can’t finish

- delaying until you “have time”

- doing one burst of activity, then disappearing again

Calendar thinking is different. It’s lightweight. It’s repeatable. It assumes you’ll be busy and imperfect. The goal isn’t to create the ultimate re-engagement campaign. The goal is to keep customers warm through a predictable rhythm.

A minimum viable follow-up rhythm has three properties:

- Light: it doesn’t require new creative every day

- Consistent: it runs on a schedule, not a mood

- Segment-aware: it changes slightly depending on where the customer is (buyer, near-miss, quiet)

If you can achieve those three, you’ll rebuild momentum even when your team is small.

The 2–4 week follow-up calendar (plug-and-play) for post-peak

This is a practical post-peak follow-up calendar you can run with a small team. It’s built around message intent, so you’re not forced into discounting.

You can run it as a simple sequence for your main customer groups, then layer in light segmentation over time.

Week 1: Thank-you + expectation setting (for buyers)

Peak buyers are still forming their impression of you. Week 1 is about reinforcing trust and setting up the next step.

Message intent:

- confirm they made a good choice

- reduce friction (support, returns clarity, how to get help)

- invite them into what comes next (without pressure)

What this can look like:

- a genuine thank-you that feels human

- “here’s how to get the most out of it” guidance

- a simple “here’s what we’ll send you next” expectation

If your support inbox is full, this email can also reduce tickets by clarifying common questions proactively.

Week 2: Use/help/value + next-best product (cross-sell with restraint)

Week 2 is where many SMBs either disappear or go straight to discounts. You can do better by staying helpful and relevant.

Message intent:

- help customers use what they bought

- show one next-best product that naturally fits

- position the recommendation as a solution, not an upsell

What this can look like:

- “3 ways to use it” or “care tips”

- “most common question answered”

- one complementary product with a clear reason it matters

Restraint matters here. If you recommend five products with no logic, it feels like a catalog. If you recommend one or two with context, it feels like service.

Week 3: Social proof + “what’s new” (relevance, not hype)

Week 3 is about reminding customers why they liked you in the first place—and making it easy to come back.

Message intent:

- make the brand feel alive post-peak

- show what others are doing with the product (or category)

- introduce what’s new without hype

What this can look like:

- customer stories, UGC, or simple “how people use this” examples

- a small “what’s new” update tied to real needs

- category-based picks (“If you loved X, you’ll like Y”)

If you’re retail/e-commerce, “what’s new” doesn’t have to mean new products. It can mean new bundles, new ways to use existing inventory, or seasonal transitions.

Week 4: Re-engagement split: active vs quiet list (gentle win-back or suppression)

By week 4, your list will naturally split into two groups: people who are still engaged and people who have gone quiet.

This is where many businesses keep blasting everyone the same way. That’s how fatigue builds.

For active subscribers:

- keep the rhythm light and relevant

- invite them to a preference click (“what are you shopping for?”)

- focus on guidance and category relevance

For quiet subscribers:

- run a gentle win-back message that resets the relationship

- if they stay unengaged, reduce frequency rather than doubling down

A gentle win-back can include:

- a simple “still want updates?” preference choice

- a short best-of recap that’s actually curated

- an easy way to opt down in frequency (if your system supports it)

The goal isn’t to force engagement. It’s to respect attention and keep your list healthy.

Soft CTA after this section:

Download the 2–4 week post-peak follow-up calendar template

Common failure modes that kill follow-up (and how to prevent them)

Even a simple calendar can fail if the underlying habits are working against it. Here are the biggest failure modes—and how to avoid them without becoming a marketing machine.

Waiting for “things to calm down”

Peak season aftermath can last longer than you think. If your follow-up plan starts “once things calm down,” it may never start.

Prevention:

- schedule the calendar now, even if the first messages are simple

- prioritize one message per week over perfection

Treating all customers the same post-peak

Your post-peak audience includes first-time buyers, near-misses, gift-related customers, and returning customers. One message won’t fit all.

Prevention:

- start with 2–3 customer groups and slightly different message intent

- even small differences (tone, product selection, timing) matter

Over-discounting and training bad behavior

Discounts can be useful, but if they’re your only follow-up lever, you’ll create a cycle: customers wait, you discount, margins tighten, you hesitate to email, engagement drops.

Prevention:

- build value-first follow-up messages (use, care, guides, social proof)

- reserve discounts for moments where they make strategic sense

No owner for the calendar

If “someone” is responsible, no one is responsible. This is especially true when the team is small.

Prevention:

- assign one person as calendar owner, even if they delegate execution

- keep the calendar visible (simple doc, board, or schedule)

No triggers (everything is manual)

Manual follow-up is fragile. It fails when you’re busy, which is exactly when you need it most.

Prevention:

- choose a few repeatable triggers (purchase, post-purchase week, re-engagement week)

- keep the system light so it survives real life

Proof posture: how to verify your follow-up system is real (not aspirational)

A follow-up plan only counts if it runs when you’re not paying attention.

Here are practical ways to verify the system is real.

Check the basics: segments, triggers, overlap, suppression

You don’t need a complex dashboard. You need confidence that the machine works.

- Do your core customer groups have reasonable counts?

- Are the right people entering the right sequences?

- Are customers receiving conflicting messages due to overlap?

- Do you have a way to reduce sends to persistently unengaged contacts?

If you can’t answer those quickly, your system may be more aspirational than operational.

Use sample-based QA: pick 10 customers and trace their experience

Choose 10 customers across different scenarios:

- a first-time buyer

- a repeat buyer

- someone who abandoned cart

- someone with a return

- someone who hasn’t engaged recently

Trace what each person would receive over the next 2–4 weeks. If the path feels coherent and reasonable, you’re on the right track. If it feels random or repetitive, simplify and add rules.

Run the “we disappear for a week” test

This is the founder reality test.

If you disappear for a week because ops explodes:

- do key follow-ups still go out?

- does anything trigger automatically?

- or does everything stop?

The more your system survives this test, the less you’ll experience the post-peak slump as a crisis.

When to add visitor identification + automated triggers to scale follow-up

As you mature your post-peak calendar, you’ll hit a ceiling if you can’t tell who’s warm. If your only signals are “bought” and “opened an email,” you’ll miss a large part of the audience—especially people who browse quietly.

That’s where visitor-level behavior can expand your follow-up targets:

- identifying who is actively returning to your site after peak

- detecting category interest even when email clicks are low

- triggering timely follow-ups based on real engagement patterns

The specifics of how visitor identification works and what signals you can rely on depend on your tools and setup (TBD). But the strategic point is straightforward: if you can’t reliably see who is warming up, you’re forced to follow up blindly or not at all.

Get a follow-up calendar built for your peak season customers.

If your peak season ended and momentum dropped, you don’t need more hustle—you need a follow-up system. We can help you map who to follow up with, what to send, and when—so it runs even when ops gets busy. Start with a simple post-peak calendar built around real customer behavior. Get your follow-up calendar →

FAQ

Why does customer engagement drop after peak season for small businesses?

Because attention shifts and warm intent decays when nothing happens next. Many SMBs are busy with fulfillment, returns, and support, so follow-up becomes inconsistent. The slump is often amplified by a lack of repeatable re-engagement rhythm.

What’s the best way to follow up after a busy season without spamming?

Use a light, consistent calendar and split your audience into a few simple groups (first-time buyers, returning customers, near-misses, quiet subscribers). Send fewer messages with clearer intent—helpful guidance, reassurance, and relevance—rather than increasing volume.

How long should a post-holiday re-engagement sequence be?

A simple 2–4 week sequence is a practical starting point for most SMBs because it gives you time to reinforce trust, add value, and reintroduce relevance without dragging the process out. Keep it lightweight enough to maintain.

Should I use discounts to re-engage customers after peak season?

Discounts can work, but relying on them as the only follow-up lever can create a cycle where customers wait for promos. Try value-first follow-up messages first—use tips, guidance, and social proof—then use discounts selectively when they fit your margins and brand.

What follow-up messages work best for first-time buyers after peak?

Messages that reinforce trust and reduce friction: a genuine thank-you, clear support/returns guidance, and simple ways to get value from the product. A restrained “next-best” recommendation can work when it’s clearly connected to what they bought.

How do I know if my follow-up automation is actually working?

Check that the right people enter the right sequences, and that customers aren’t receiving conflicting messages due to overlap. Then do sample-based QA: pick 10 customers across different scenarios and trace what they would receive. Finally, run the “disappear for a week” test—if key follow-ups still go out, the system is real.

Get a follow-up calendar built for your peak season customers

If your peak season ended and momentum dropped, you don’t need more hustle—you need a follow-up system. We can help you map who to follow up with, what to send, and when—so it runs even when ops gets busy. Start with a simple post-peak calendar built around real customer behavior. Get your follow-up calendar →

RELATED LINKS: